- Transparency to invest in what you want with whom you want.

- 3CF provides identification and verification of all authorised individual/business borrowers and assigns them an indicative credit rating based on their credit rating with other reputable agencies.

- 1st come-1st served – fund what you see on the platform.

- Opportunity to invest in multiple loans at the same time or multiple times in a single loan.

- 3CF offers an autoinvest function for automatic bidding.

- The Secondary Selling Market allows you to buy and sell loan parts.

- 3CF allows for the electronic signature and exchange of contracts.

- 3CF manages and apportions monthly payments to lenders.

FAQs about Crowdlending

Who is eligible to apply for a loan?

Responsible individuals who are resident in Switzerland and at least 18 years old and businesses that are registered in Switzerland.

How do I complete my registration for a personal/business loan?

Once you have registered with a user name and e-mail address, you will receive an e-mail from 3circlefunding.

1. You need to click the link in the e-mail to confirm your e-mail address.

2. Once you have confirmed your e-mail address, you will need to log-in.

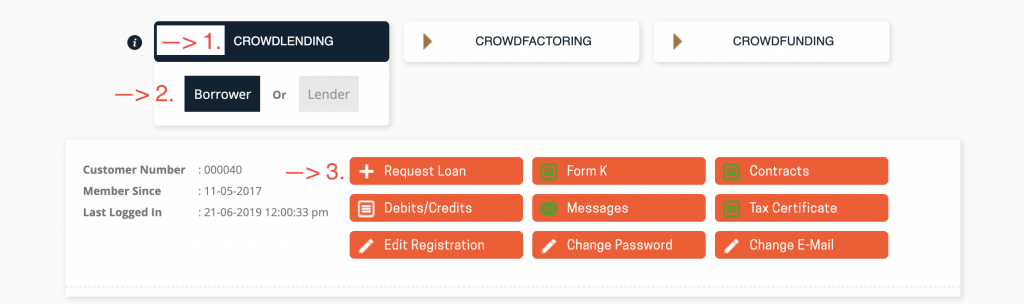

3. Select “Crowdlending”

4. Select “Borrow”

5. Select “Request Loan”

6. Complete the form

7. Pay the administrative fee via bank transfer with the given reference number

Will I get a refund of my listing fee if my application for a loan is not posted on the 3CF platform?

As an individual borrower, the listing fee is not refundable, as this will cover administrative costs involved in the identification, verification and filtering of the loan application requests.

Business borrowers will receive a 50% refund if not listed on the platform.

How long does it take to process a loan application?

Private loan applications take 3 working days.

Businesses loan applications take 3-5 working days.

How often can I apply for a loan with 3CF?

For individuals, as many times as you want. Before a new loan can be granted, the previous loan must be paid back in full.

Businesses can apply for both Crowdlending and Crowdfactoring loans multiple times and have several loans running simultaneously.

Can I remain anonymous on the 3CF platform for Crowdlending loans?

Only individual persons can remain anonymous on the 3CF platform. Personal details will only be available to registered borrowers and lenders on the Loan Agreement Contract/Accession Agreement. This information will never be made public on the platform.

For transparency reasons, businesses cannot remain anonymous to registered users on the platform.

Can users on the platform communicate with each other?

Yes, registered members can contact each other before and during the bidding process on the platform. After the loan bidding has closed, communication between members is only possible by private contact via their respective dashboard.

How is the credit rating formulated?

3CF analyses information provided from 3 credit checks agencies (Creditreform, Bisnode and CRIF). This information, together with other personal details, enables 3CF to formulate and assign an indicative credit rating concerning all loan applications.

What are the minimum and maximum loan amounts on 3CF?

- Individuals can raise 5,000 to 250,000 CHF.

- Businesses can raise 25,000 to 500,000 CHF.

What are the minimum and maximum periods for loan repayment?

Both Individuals and businesses can repay loans within a range of 1 to 60 months.

How is the loan interest rate determined?

On 3CF the loan applicants determine the interest rate they want to pay on their loan. For individuals, a maximum of 10% can be offered.

What is a Form A?

Form A is a declaration that the borrower/lender is the beneficial owner of all funds deposited in the 3CF escrow account.

What are the advantages of borrowing with 3CF?

- Alternative social funding channel.

- Ability to set your own loan parameters.

- 3CF provides an indicative credit rating to attract investors on the 3CF platform.

- 3CF allows for the electronic signature and exchange of contracts.

- 3CF administers the collection, receipt and distribution of loan repayments to lenders.

What are the advantages of lending with 3CF?

Are the loans guaranteed?

Loans on the 3CF platform are not guaranteed. Individuals are not required to cover the loan with collateral or death insurance. Business loans are not secured.

What happens if a loan request on the 3CF platform is not fully funded?

The loan request will be deleted from the platform and the borrower is more than welcome to apply again.

What happens if a party does not sign the loan agreement?

All parties must sign the Loan Agreement contracts within the requested time limits. If one or more of the involved parties does not sign the Loan Agreement contract on time, the contract becomes null and void. Thereafter, the loan will be published again on the 3CF platform, this reposting attracts no fees.

What happens in the event that a lender does not deposit the funds to back their respective bid?

All lenders must honour their respective bids by depositing the required funds in a timely manner in the 3CF escrow account. If one or more lenders fail to deposit the required funds, all loan agreement contracts will become invalid – null and void. In this event, all deposited funds will be returned to the originating lenders within 3-5 working days from the voiding of the contract. In this instance, the loan will be reposted on the 3CF platform at no extra charge to the borrower.

When does the borrower need to pay the 3CF service fee?

The entire service fee is deducted from the loan amount before the payment is made to the borrower.

When do the lenders need to pay the 3CF service fee?

The entire service fee is payable together with the payment for the lender’s respective loan bid.

How are the monthly repayments by the borrower handled by 3CF?

The monthly payments are deposited by the borrower in the 3CF escrow account. Thereafter, 3CF apportions the respective instalment amounts to the appropriate lenders.

Can I pay my loan back earlier than scheduled?

Yes, early settlement is possible. The whole remaining outstanding loan amount (principal amount plus remaining interest) can be paid back before the end of the loan term. 3CF does not charge for this service.

What happens if a borrower fails to make a payment on time?

We will remind the borrower of their respective obligations under the Terms and Conditions. We will send the borrower two reminders and inform the lender if the borrower has failed to make a payment. We will endeavour to get the repayment schedule back on track.

Is it possible to renegotiate the terms of the loan agreement?

No, 3CF does not allow for loan agreements to be renegotiated once they are signed.

What is the Crowdlending Secondary Market?

Secondary Selling Market is where registered lenders can sell their loan parts to other registered lenders on the platform to free up their illiquid loans if the need arises. The Secondary Selling Market is open to registered lenders (both individuals and businesses) who would like to buy loan parts from other registered lenders (additionally from both individuals and businesses). Secondary Selling Market enables lenders to sell their loan part, either at cost rate, premium rate, flat fee or at a % discount rate.

Can a lender always sell their Crowdlending loan part?

Yes. For processing reasons, the lender cannot sell their loan part less than 10 days before the next due instalment.

What is Autoinvest for Crowdlending?

Autoinvest enables registered lenders to set-up and automatically fund loans with predefined buying criteria. Autoinvest is open to both individuals and businesses enabling them to invest in individual borrowers’ loans posted on the website, but Autoinvest does not facilitate automatic bids to fund Crowdlending business loans posted on the website.

Last updated: 2019-07-22